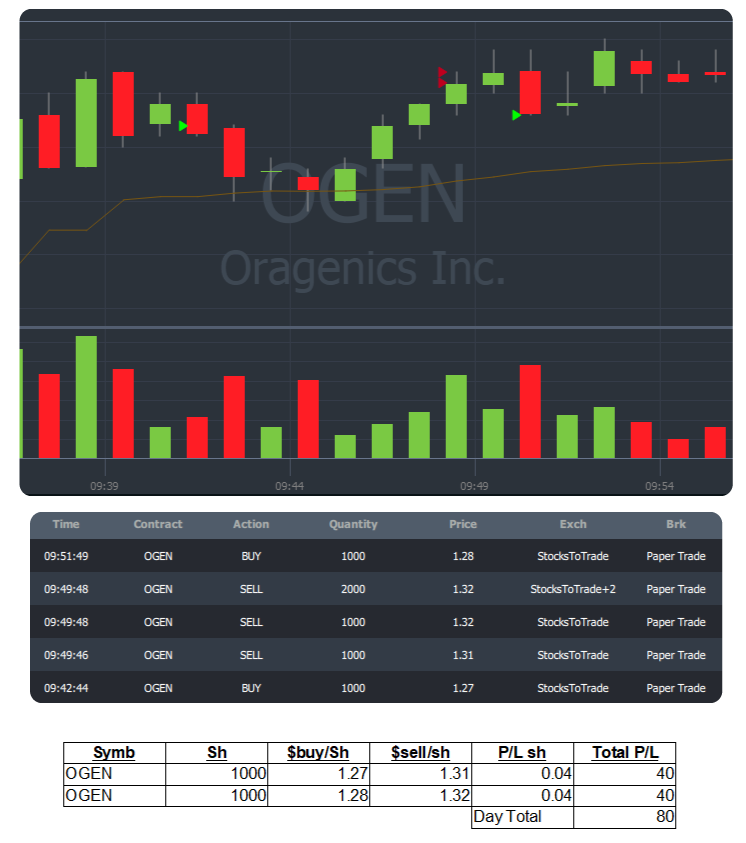

| Trade Totals – Week of Nov 26-30 |

| Date |

P/L |

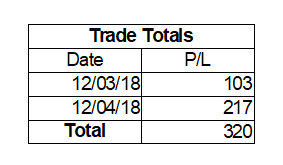

| 11/26/18 |

-$5.20 |

| 11/27/18 |

$273 |

| 11/28/18 |

$155 |

| 11/29/18 |

$280 |

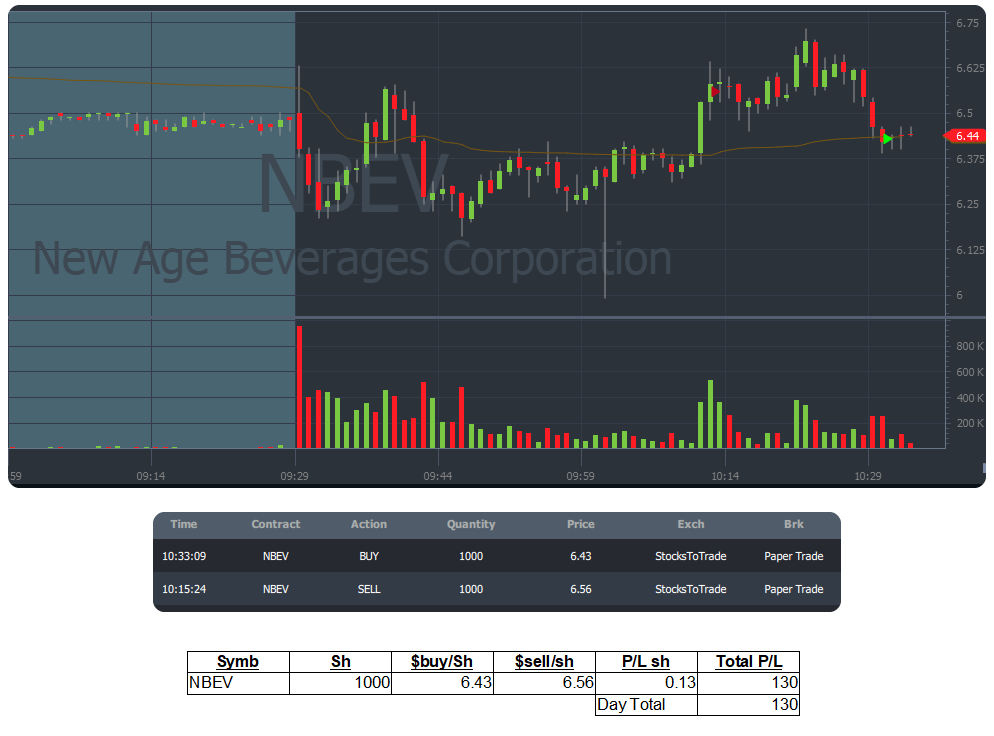

| 11/30/18 |

$130 |

| Total |

$832.80 |

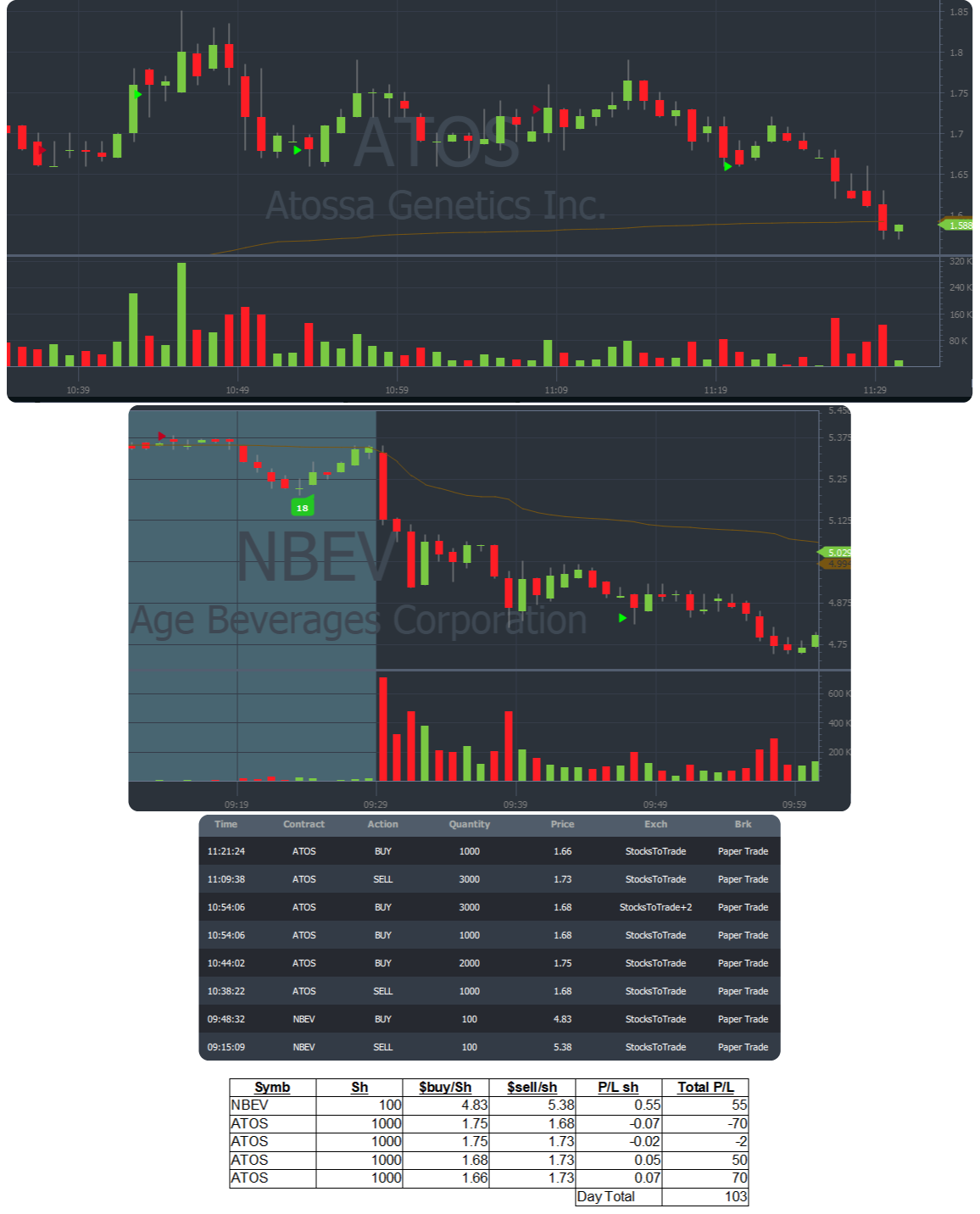

I am happy with my results this week, In thinking back over the paper trades this week as long as I stuck with my plans and stocks I was watching they turned out well. Monday I made a mistake and followed an alert, but cut the loss quickly and realized I should not have played it. Key stocks I watched and played paper with this week were $ANY, $ASNS, $ALQA, $OGEN, and $NBEV. $PURA was my Monday play they was following an alert while it had some movement I wasn’t watching for right entry and exits and simply made a mistake following an alert. Following that one I made sure and followed my own stocks and made my own plans the rest of the week. All in all happy with how it is progressing and really considering going real next week.